What We Do ?

We provide equity investment advisory services to investors using in-depth fundamental research.

We at ‘White Equity’, strive to set high standards of honesty and transparency with all stakeholders in our ecosystem.

Our Unique Qualities

Risk Evaluation

While making equity investments in listed Companies, risks emanate from Financials, Business, Management and Valuation. While taking investment calls, most investment houses focus on one or two of these important parameters, often ignoring risks emanating from others. When the ignored risks materialize, their portfolios significantly under perform.

At White Equity, our detailed ‘Research Process‘ ensures equal focus on each of these parameters, thereby significantly reducing the investment risk.

Low Cost Structure

We have organised ourselves in a way that we can deliver top quality equity advisory services, using our in-depth fundamental research, at extremely low cost. This unique blend allows us to charge minimal advisory fees, thereby magnifying net returns of our clients.

Skin in the Game

After advising our clients to invest in a Company, Investment Advisor invests his own funds in the same set of Companies, often with similar allocation.

We Select Our Clients

We minutely look at and advice each client portfolio independently, in contrast to widely followed ‘model portfolio’ approach. Besides, we spend considerable time explaining our philosophy and process thoroughly before initiating client sign-up process. This limits our ability to on-board and service too many clients and gives us the opportunity to select only the best of the clients.

Services Offered

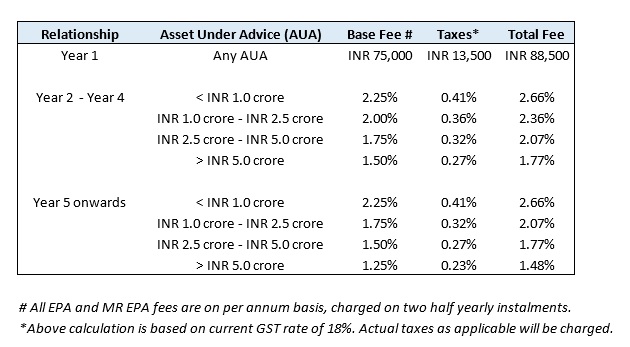

Equity Portfolio Advisory Services (EPA)

We advice our clients on building and managing an equity portfolio, largely comprising of High Quality Companies, available at discount to Intrinsic Value.

– Minimum Commitment Amount: INR 25 lacs

– Commitment Period: Four years

– Fees: Fixed % per annum on the funds under our advice

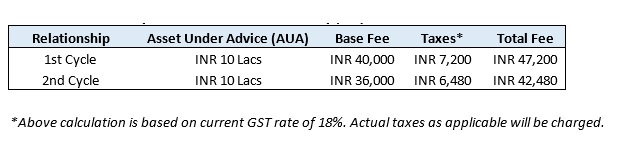

Systematic Investment Advisory (SIA)

We advice our clients on investing their funds across 8-12 High Quality Companies, wherein 30-60% allocation will be done in Anchor stocks.

– Minimum Commitment Amount: INR 10 lacs

– Commitment Period: 2-5 years

– Fees: One time fees of INR 40,000 + Taxes

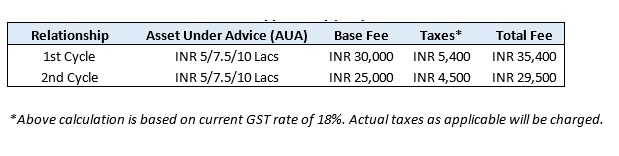

Anchor Investment Opportunity (AIO)

We advice our clients on investing their funds across 5 Anchor Stock ideas.

– Minimum Commitment Amount: INR 5Lacs – INR10 lacs

– Commitment Period: 2-5 years

– Fees: One time fees of INR 30,000 + Taxes

Customised Advisory Services

If you are a UHNI or Institutional Investor, wanting to retain idea generation and investment decision taking functions, but want us to diligently perform in depth fundamental research on your investment ideas using our Research Process, we can design a customised advisory service for you.